Sports

Pay for Lawyers Is So High People Are Comparing It to the N.B.A. – The New York Times

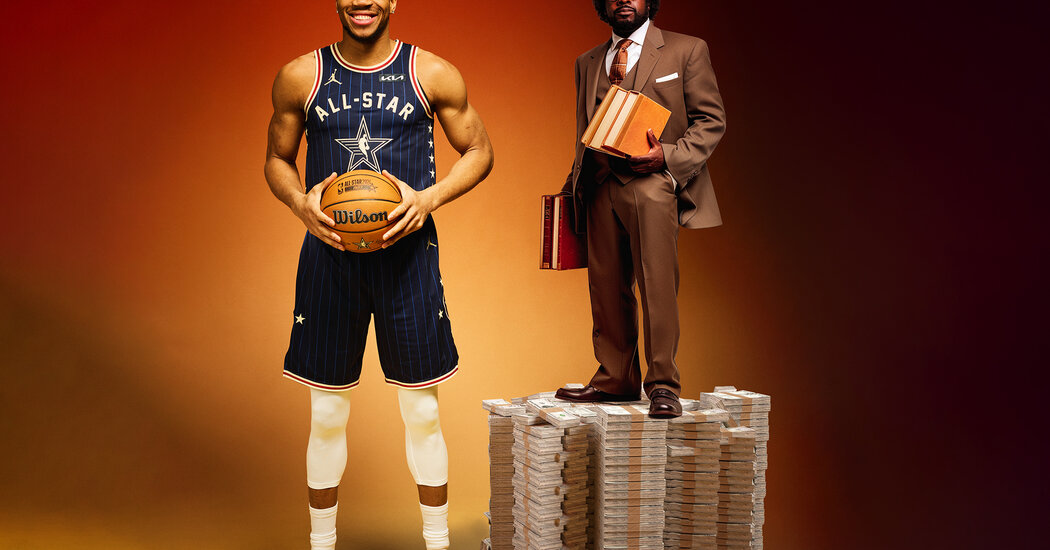

Enormous pay packages are popping up for top lawyers, especially those favored by well-heeled private equity clients.

Credit…Guillem Casasús

Supported by

Maureen Farrell and

Hotshot Wall Street lawyers are now so in demand that bidding wars between firms for their services can resemble the frenzy among teams to sign star athletes.

Eight-figure pay packages — rare a decade ago — are increasingly common for corporate lawyers at the top of their game, and many of these new heavy hitters have one thing in common: private equity.

In recent years, highly profitable private equity giants like Apollo, Blackstone and KKR have moved beyond company buyouts into real estate, private lending, insurance and other businesses, amassing trillions of dollars in assets. As their demand for legal services has skyrocketed, they have become big revenue drivers for law firms.

This is pushing up lawyers’ pay across the industry, including at some of Wall Street’s most prestigious firms, such as Kirkland & Ellis; Simpson Thacher & Bartlett; Davis Polk; Latham & Watkins; and Paul, Weiss, Rifkind, Wharton & Garrison. Lawyers with close ties to private equity increasingly enjoy pay and prestige similar to those of star lawyers who represent America’s blue-chip companies and advise them on high-profile mergers, takeover battles and litigation.

Numerous people compared it to a star-centric system like the N.B.A., but others worried that higher and higher pay had gotten out of hand and could strain the law firms forced to stretch their budgets to keep talent from leaving.

“Twenty million dollars is the new $10 million,” said Sabina Lippman, a partner and co-founder of the legal recruiter Lippman Jungers. In the past few years, at least 10 law firms have spent — or acknowledged to Ms. Lippman that they need to spend — around $20 million a year or more to lure the highest-profile lawyers.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in.

Want all of The Times? Subscribe.

Advertisement