Sports

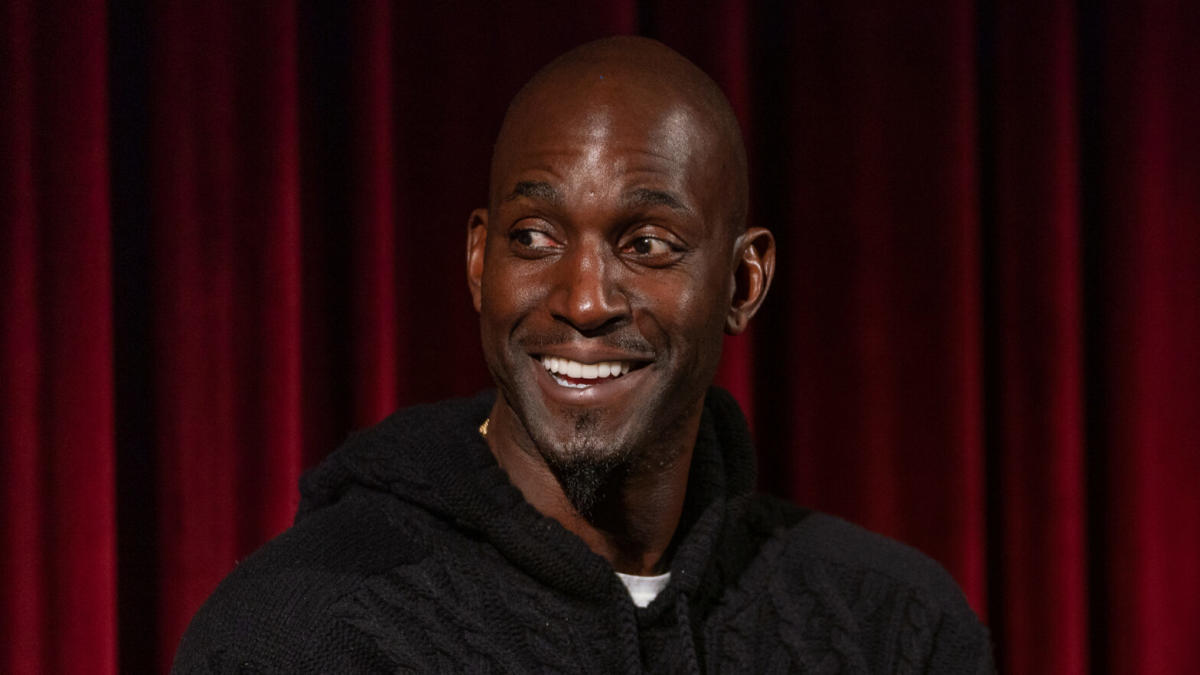

Kevin Garnett Has Reportedly Been Paid $5M A Year By The NBA’s Boston Celtics Since Retiring In 2016 – Yahoo Finance

Kevin Garnett is still making bank after retiring from the NBA in 2016.

His good fortune first dates back to 1995. Per Bleacher Report, he was drafted as a fifth overall pick in the 1995 Draft to the Minnesota Timberwolves and immediately made his presence known. He helped the team reach the finals for eight consecutive seasons, notes the NBA.

He would go on to play for the Boston Celtics (2007–2013), earning his first and only championship ring.

“I consider Boston one of the pillars of the league,” Garnett said, according to an Instagram post.

His basketball career would then lead him to the Brooklyn Nets (2013–2015) before retiring with with the Timberwolves (2015–2016).

“It has been a real joy to watch KG come into the league as a young man and watch him develop his skills to become one of the very best in the NBA,” Timberwolves owner Glen Taylor said, according to NBA. “I have treasured the opportunity to see him grow as a leader. I wish him continued success in the next chapter of his life. His Minnesota fans will always cherish the memories he has provided.”

Throughout his career he secured several feats including being a 15-time All-Star, winning the 2004 NBA MVP and the 2008 NBA Defensive Player of the Year Award, among other accolades.

He played in the league for 21 seasons and reportedly earned a total of $334.3 million, according to Bleacher Report.

With his time on the court behind him, Garnett is still scoring a slam dunk. NBC Sports mentions that according to two close sources he has been earning $35 million over seven years from the Boston Celtics since his retirement. The hefty payout is from a deferred salary and is set to expire in 2024.

Kevin Garnett retired from the NBA in 2016, but set up his deal with the Celtics so that he’d get paid $5 million every year until 2024.

Smart. 💰 pic.twitter.com/yjRVFuAhEl

— NBA Retweet (@RTNBA) October 10, 2023

NBA icon Magic Johnson has become the fourth sports star to reach billionaire status, with a net worth of $1.2 billion, according to Forbes’ calculation.

The former basketball star is only the fourth sportsperson to make it onto the exclusive Forbes list of billionaires.

Mark Cuban is well known as one of the best businessmen and investors in the world. Kevin Hart is most often associated with his comedy acts and side-splitting exploits on the big screen. But there's one thing the two have in common: They both missed out on — and regret — the opportunity to invest in Uber Technologies Inc. Just like these celebrities, you have the opportunity to make ground-floor investments in up-and-coming startups. It's simple to do so via crowdfunding platforms like StartEng

Magic Johnson, 64, becomes the fourth athlete to earn billionaire status on Forbes' list, after Michael Jordan, LeBron James and Tiger Woods

Here’s how to buy into a pro sports team and a few of the best available options.

Problems are piling up for electric vehicles. That's not good for Tesla, or any other auto maker.

Sarepta Therapeutics unveiled new data for its gene therapy to treat Ducchenne muscular dystrophy on Monday. Shareholders aren’t happy: The stock is down 47% in early trading Tuesday. The company said that patients treated with Elevidys showed increased motor function, compared to patients who received placebos at 52 weeks.

A prosecutor asked Sam Bankman-Fried about testimony by former FTX software developer Adam Yedidia. + Earlier in the trial, Yedidia told jurors that after fixing an accounting bug in the summer of 2022, he warned the crypto entrepreneur that Alameda Research owed $8 billion to FTX. + “I don’t remember him saying it that way,” Bankman-Fried said today.

Palantir (PLTR) third-quarter 2023 earnings and revenues are likely to have surged year over year.

e.l.f. Beauty's (ELF) strong business fundamentals, strategic acquisitions, focus on innovation and international expansion position it favorably ahead of its Q2 earnings release.

The Zacks Consensus Estimate for Nikola's (NKLA) third-quarter 2023 loss per share and revenues are pegged at 15 cents and $15.52 million, respectively.

Savings bonds purchased in the six months starting Wednesday will initially pay 5.27%, up from 4.3% in the six months ending Tuesday.

Rivian Automotive (RIVN) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Steve Ballmer joined Microsoft in 1980 as Bill Gates' assistant, became CEO in 2000, and retired in 2014 with a 4% stake that's worth a fortune today.

The Dow Jones Industrial Average added to the morning's gains and was up nearly 500 points, or 1.5%, in early afternoon trades Monday. The gains came as the Federal Reserve prepared for a two-day meeting starting Tuesday. Fed Chair Jerome Powell and the rest of the governing body are widely expected to keep rates unchanged.

Sickle-cell disease has afflicted people of African descent for generations, causing agony and death among those who inherit its deformed red blood cells. The end of that unhappy inheritance inches closer on Tuesday—as the Food and Drug Administration asks a panel of experts to weigh in on what’s likely to be the country’s first-approved genetic treatment for the disorder. Developed by Vertex Pharmaceuticals (ticker: VRTX) and Crispr Therapeutics (CRSP), the “exa-cel” therapy would also be the first product marketed in the U.S. that employs the Nobel Prize-winning technology called Crispr.

Depending on your age, if your income is below a certain threshold, you may not have to pay taxes. Here's what you need to know.

In a trial of gene therapy Elevidys, patients on the drug didn't show a statistically significant improvement over patients who received a placebo in the primary measure used.

Charles Schwab on Monday began laying off employees across the company. Schwab, the largest publicly traded U.S. brokerage, didn’t disclose how many employees were affected in an internal message seen by The Wall Street Journal.

Berkshire Hathaway Inc. Chairman and CEO Warren Buffett is no stranger to missed opportunities, but one that particularly stings is his decision not to invest in Amazon.com Inc. during its early days. "I blew it," Buffett has said about passing on the online retail giant not once but twice. In 1994, when Amazon was just getting started, Buffett decided against investing in what was then just an online bookstore. The same happened in 1997 when Amazon went public. At that time, even Wall Street wa